Greetings from FrankonFraud, I’m always hunting for new fraud schemes, trends, and interesting stories shaping the industry we love working in.

This week we saw:

A new wave of unemployment fraud hits multiple states

Fednow launched, and it’s very quiet on the fraud front

A great one lost, Kevin Mitnick passes away

Hong Kong Police hijack over $11 Billion in scam attempts

Barclays wins a $1 million scam case lawsuit by a customer

Turo rental moguls sometimes turn to loan fraud

Peru reports uptick in AI Fraud for Extortion

A Sneaky Ghost Employee “Clock In” Fraud

New Reverse BEC Attacks are emerging in Russia

Let’s get to the top stories of this week!

Another Big Unemployment Fraud Wave Hits Multiple States

Unemployment fraud continues to be a problem, and 3 states are the most recent target of scammers - Ohio, Connecticut, and Colorado.

It appears that states are getting hit with a combination of new application fraud and account takeover.

It’s Eerily Quiet On The FedNow Fraud Front

The much anticipated FedNow Program launched on July 20th.

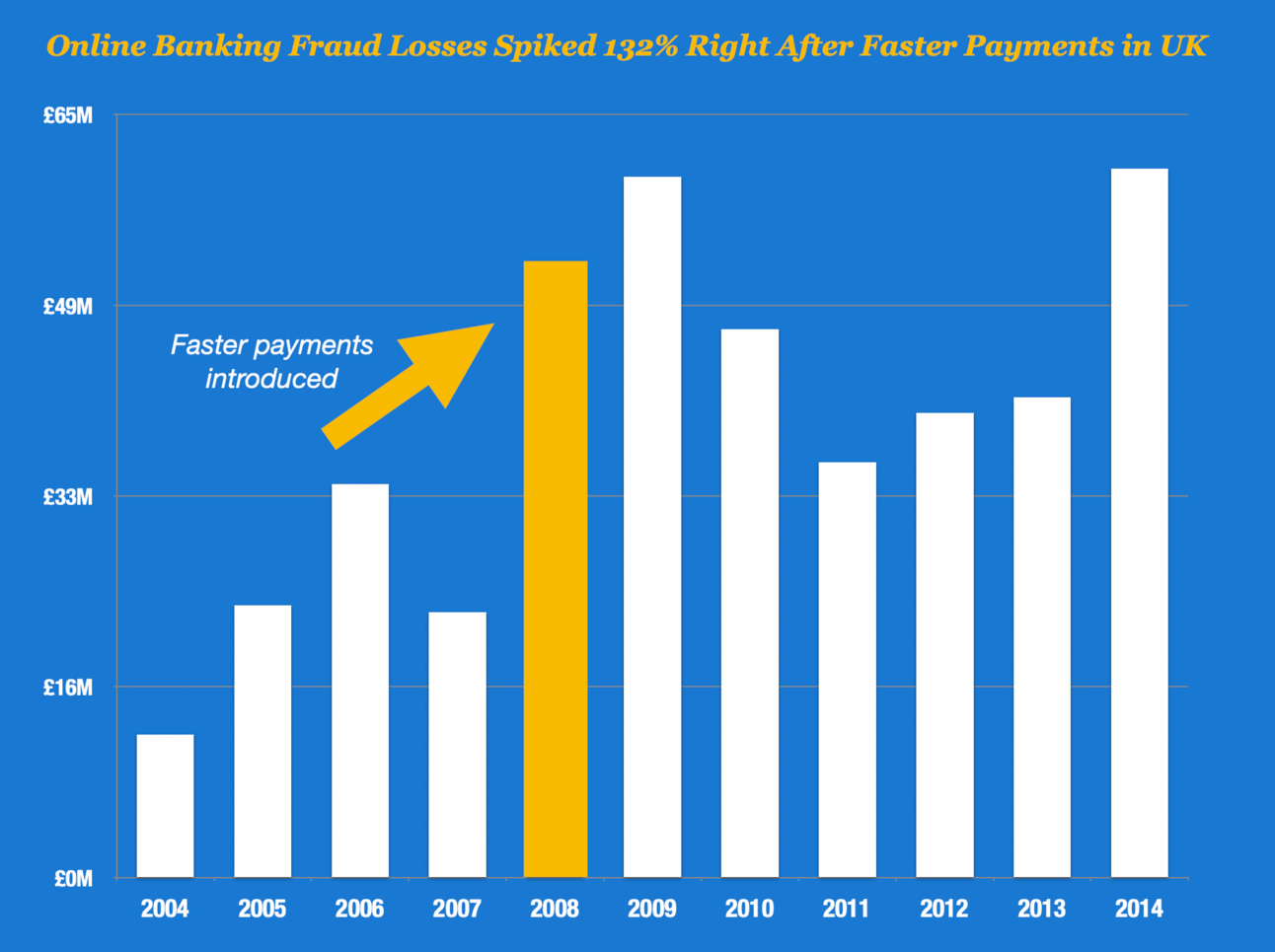

Many fraud experts have been holding their breath, expecting the tried and true postulate – Fast Money = Fast Fraud will come to fruition.

In 2008, that’s what happened when they launched faster payments - fraud doubled. And it only took three days for the ATO attempts to spike at banks and for everything to go haywire.

But so far, things have been eerily quiet. Is it too quiet?

I guess only time will tell.

Hustling on Turo Can Lead To Slippery Slope Of Fraud

You can make big money financing luxury cars and then putting them on Turo as a side hustle. Or, in some cases, a full-time job.

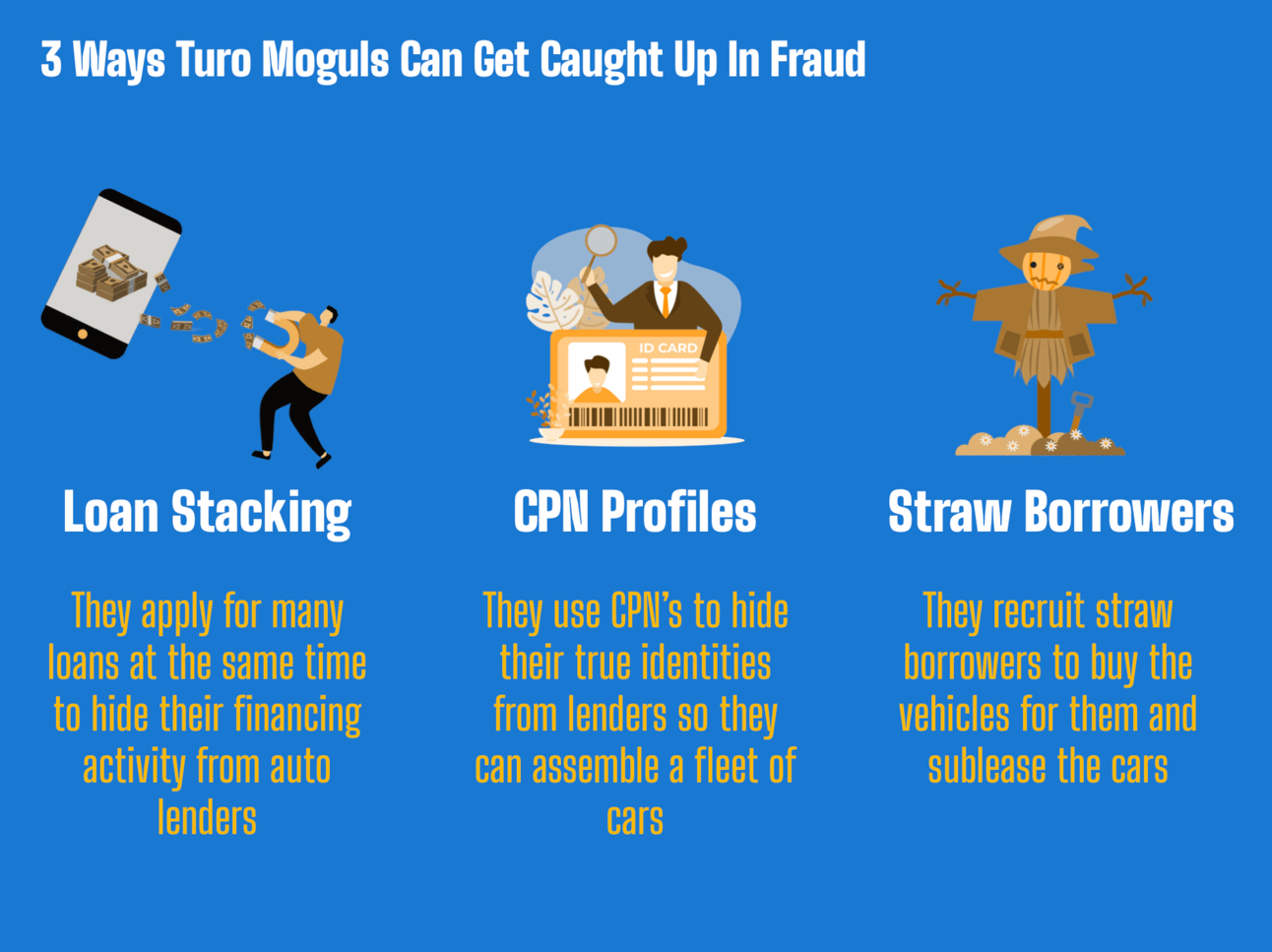

I spoke to Ben Eisen with the Wall Street Journal about Turo moguls that assemble fleets of cars and how some could fall into the trap of fraud to get those cars.

The schemes could include loan stacking, using CPN profiles or even engaging in sophisticated straw borrower or subleasing schemes to get those cars to rent out.

Turo-related fraud and subleasing is a form of fraud that shot up during the Pandemic as rental agencies scaled back their fleets.

Barclays Wins Big APP Scam Case

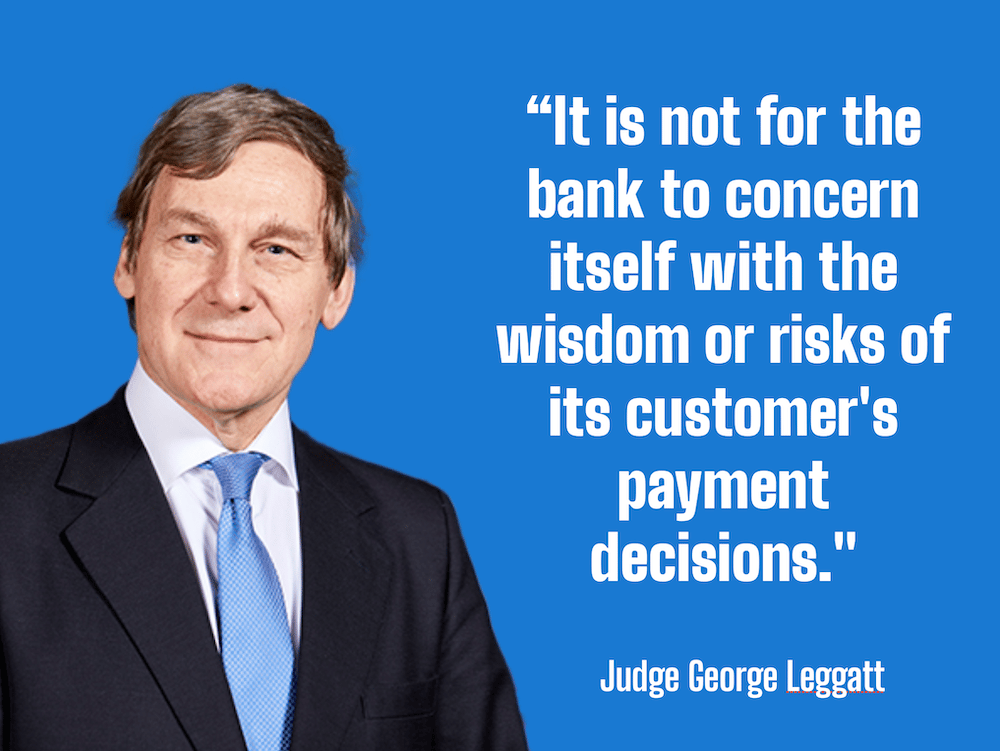

Barclays averted a disaster and won a landmark case that will likely set a legal precedent on scams for years. And probably save them hundreds of millions too.

Fiona Philipp, a long-time customer of Barclays, sued the bank in 2020 after she was tricked into transferring 700,000 pounds to accounts in the United Arab Emirates in an elaborate authorized push payment fraud.

The judge, however, sided with Barclay, saying it was not their concern to worry about her payment decisions.

An interesting legal precedent might be set here!

Ghost Employee Clocked In For A Year, Collected $20K In Fraud From Wendy’s

An owner of a Wendy’s restaurant in Louisiana was looking at their payroll records when they noticed a man named “William Bright” collecting paychecks every two weeks.

They had never met the guy before, so they started investigating. It turns out store manager Lisa Johnson had created a ghost employee who was clocking the ghost in daily.

Peru Experiencing Big Uptick In AI-Enabled Fraud

Fraud groups in Peru are taking clips of voices from YouTube, Instagram, and WhatsApp, feeding them into deepfake software to clone, and then using voices in impersonator scams.

An investigation by El Comercio found that at least 55 reported instances of AI deepfake fraud used in ransom and extortion attempts.

Tools like Resemble.Ai make it very easy for fraudsters to clone voices for as little as a $20 a month subscription to the platform.

9 JailBirds Make $5 Million From Their Cells

How did these jailbirds pull off a $5 million heist from the confines of their jail cells?

They ran a massive racket by collecting social security numbers and other PII from other inmates and then applying for fraudulent unemployment benefits across the US.

But they also ran a more insidious scheme, using illegal cell phones to trick people outside the prison into sending them nude photos. Later they would call the victims impersonating Law Enforcement and get the PII from the victims that they would also use to apply for fraudulent benefits

Hong Kong Police Hijack $11 Billion In Scam Attempts

Hong Kong Police have a novel way of hijacking money from scammers after people wire funds. And it’s awesome.

It’s called the Anti-Deception Coordination Centre, and they will intercept and freeze funds in bank accounts. So far, they have hijacked nearly $12 billion that victims had wired to scammers since they started in 2017.

When someone reports the crime to them, they work with agencies internationally and leverage things like the Interpol International Stop-Payment Mechanism to freeze or recover funds.

Way to go, Hong Kong Police! 👏👏

Scam Rapper Says He Has The “Dream Job” Will Scam Until He Is Old

“You have to have a way of covering it up. Some of us do videos, some of us rap, some of us sell clothes”.

That’s what rapper PunchDev, the infamous scam rapper that got himself in hot water with his Wire Fraud video, said you must do to succeed in the scam game.

He even brags that he uses TransUnion’s TLO to pull up social security numbers and even demo’s it (although the screen is blurred out). There are hundreds of posts on Telegram with scammers selling TLO lookups.

Check out this investigation into the most famous rap scammer and watch him “re-enact his crimes” but honestly it looks quite real.

Ever Heard Of Reverse BEC Fraud? Neither Had I, Until I Read About This New Trend

I recently read a blog post by CyberSecurity expert Tom Kellerman where he outlined a new cybersecurity trend called Reverse BEC Attacks.

He calls it the “modernization of BEC Attacks” because it goes far beyond traditional spearphishing emails where fraudsters trick people into sending wire transfers.

With reverse BEC, hackers commandeer an organization's Office 365 admin rights and, very selectively, through the use of machine learning, send out fileless malware against the board and the most senior executives from other companies that communicate with that organization.

Apparently this technique is being actively used by Turla - an FSB Russian intelligence agency - as they attack Ukrainian defense forces.

About Fraud - The Rise Of First Party Fraud Webinar

It’s here! The About Fraud Webinar on First Party Fraud is this week.

I will be on the panel with the Inscribe, CoastPay and the great Ronald Praetsch to talk about First Party Fraud. You can join too, it’s free and promises to be a great event.

It was 23 years ago, that I started my journey on trying to solve First Party Fraud working with some of the smartest people at Barclays on the problem. Things have certainly changed since then.

Thank you for catching up on the latest trends and stories.

Have an amazing week fighting fraud and let me know if any of you out there hear of any new fraud trends!